Press release

MOLDOVA - IMF and World Bank Group Membership The 25th Anniversary: Achievements and Challenges

By Alex M. Tanase and Vasile Patrascu

Independence, Membership and Own Currency

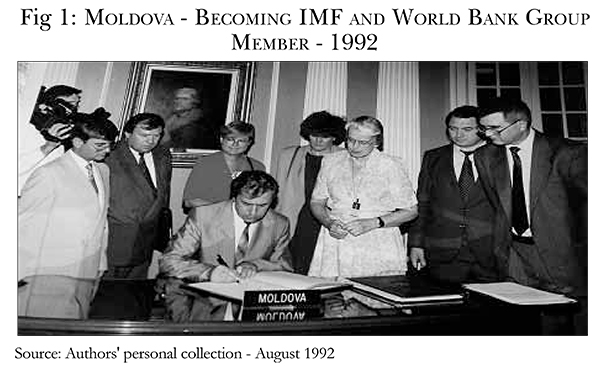

The Republic of Moldova became an independent state on 27 August 1991, in the aftermath of the Soviet Union's dissolution. One year later, in August 1992, Moldova became a full member of the International Monetary Fund (IMF) and the World Bank Group following a preparatory process which was fully supported by the Dutch, Moldovan and Romanian authorities, on one side, and by the IMF, on the other side. The memberships in these both financial organisations (see Fig.1) represented an important achievement for the new Moldovan authorities. The signing of the IMF's Articles of Agreement and World Bank's statute by the then Prime Minister Andrei Sangheli on 12 August 1992 was well covered by the Moldovan media. The daily newspaper Moldova Suverana informed the Moldovans accordingly on this important achievement.

As originally hoped, by achieving membership in both international institutions, Moldova benefited, first and foremost, from financial support for its reforms to a market economy. Also, Moldova received technical assistance, including training for key Moldovan staff from the banking and public financial sector. However, more importantly, Moldova's cooperation with both the IMF and the World Bank Group (including the International Finance Corporation (IFC) and Multilateral Investment Guarantee Agency (MIGA)) helped it to have access to international capital markets, to obtain good international ratings and finally to negotiate and sign, on 27 June 2014, a Deep Comprehensive Free Trade Agreement (DCFTA) with the European Union (EU). Also, these laid out the foundations for the new Moldovan currency which was to be issued one year after membership.

Back in 1992, the preparation for the membership in both institutions was then the prerogative of the then Ministry of Economy and Finance. The Moldovan staff involved was in permanent contact with the IMF's Office of the Executive Director for a group of countries led by the Netherlands and including Romania (Mr. G. Posthumus was then the Executive Director for the whole group). Moldova's quota was not very large (SDR 50 million), reflecting the status of the nascent Moldovan economy. Today, Moldova's quota is of SDR 172.5 million, with a 0.06% voting power. To put it in the context, this quota is bigger in financial terms than that of the Former Yugoslav Republic of Macedonia (SDR 140.3 millions), but with the same voting power of 0.06%. The current Governor for Moldova at the IMF is Mr. Sergiu Cioclea, after two previous Governors of the National Bank of Moldova (NBM) also served as Governors for Moldova at the IMF.

Over a quarter of a century, Moldova has be-nefited from many financial programs, not only the usual stand-by arrangements, but also from more specific IMF facilities such as Extended Fund Facilities (EFF) and Extended Credit Facilities (ECF). These are granted with special terms and conditions to qualifying countries only. Amongst the latest such facilities, an EFF was approved by the IMF on 29 January 2010 for an amount of 184.8 million (disbursed at the level of SDR of 149.2 million before it expired). The most recent facilities were (EFF and ECF) for a total amount of SDR 129.4 million (USD 178.7 million) were signed on 7 November 2016 and started to be disbursed. The conditionality of this last program is rich, especially on the banking sector supervision and restructuring of this key sector. As of end-February 2017, an amount of USD 35 million was disbursed to Moldova. One more review of the next tranche was in April 2017. The Moldovan authorities have indicated their full commitment to this economic reform program.

The IMF and the World Bank are prestigious financial institutions having currently 189 member countries (as compared to 156 members back in 1992). The two Bretton Woods institutions were established in 1944 in the aftermath of the World War II and their original aims were, amongst others, to promote international coope-ration, maintain price stability and make financial resources available to members needing balance of payments support. The World Bank and IFC also finance development projects in various files of activities, with a significant positive impact on economic development and finally on the peoples' welfare.

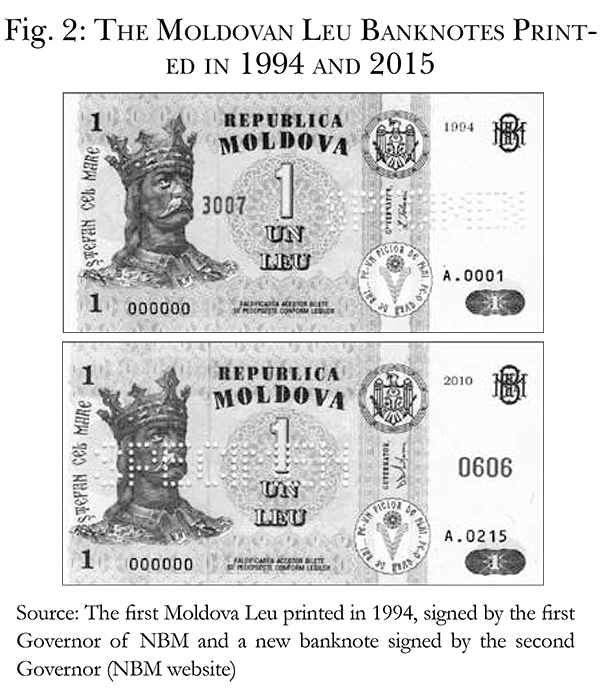

Based on results achieved in implementing reforms, the Moldovan Leu has managed to remain stable in the first 5 years after it was put into circulation. On 29 November 1993, the first exchange rate for Leu was established administratively by the NBM at 3.85 lei/USD (see Fig. 2).

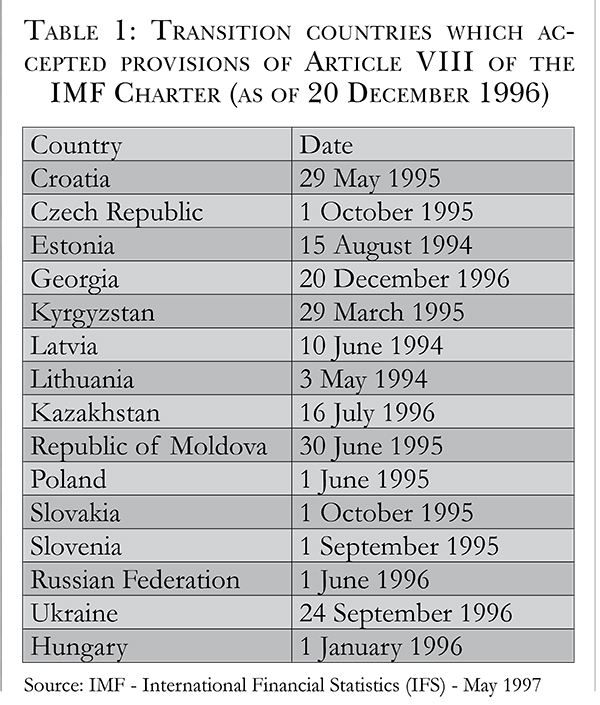

By the end-1994, the depreciation process was relatively mild at 4.27 lei/USD, at 4.50 lei/USD as of end-1995 and at 4.66 lei/USD by the end-1997. Under these circumstances, Moldova accepted the provisions of Article VIII, Sections 2, 3, and 4 of the IMF Articles of Agreement on 30 June 1995. This was done before Romania, which signed Article VIII on 25 March 1998 only, despite the fact that Romania was a full member of the IMF since 15 December 1972. The IMF members accepting these provisions undertake to abstain from introducing any restrictions regarding international payments and current account transfers and to eliminate any discriminatory practices on foreign currency regimes. This means, de facto, a current account currency convertibility.

In the first part of its transition, Moldova was a country which implemented in an exemplary manner all agreements concluded with the IMF and other International Financial Institutions (IFIs), especially with regards to the level of credit and structural reforms. Based on the good results in the implementation of reforms, Moldova succeeded to obtain favourable quotes from reputable international agencies during the ‘90s (see Table 2). However, this advantage was lost due to the severe political, financial and banking developments during the last 3-5 years. For instance, a new recent quote from Moody's Investors Service was of only B3 on 13 January 2017 (with stable outlook) and this was possible only after a new agreement with the IMF. Moreover, one should note that the perception of the role of both international institutions at the level of the population is quite different today as compared to the ‘90s. The conditionality of the programs agreed/loans contracted from the two institutions is often seen by the general public as too laborious. The relatively low living standards of the population (it is estimated that some one million of Moldovans left Moldova for better living standards abroad) make the task of the IMF and the World Bank even more difficult, but their positive contributions should not be oversighted.

The economic potential of the country is quite good compared to its geographic and human dimensions, but it is not used to its highest level. By the time of the introduction of its currency, Moldova registered a sharp economic decline (-31% of GDP in 1994 and -3.2% in 1995, after another four previous years of massive reductions of GDP during 1990-1993). Inflation was extremely high (1,283% in 1993 and 587% in 1994) and the state budget deficits were also very high (some 5-8% of GDP). Despite the so called zero option (no foreign debt, no external assets), Moldova's foreign debt started to accumulate at a rapid pace. The level of USD 700 million was reached already by October 1996. By the mid-1997, the same indicator reached USD 1 billion, according to the figures published by the NBM. This represented 50% of the Moldovan GDP which was quite concerning. Moreover, over the next 20 years, the Moldovan foreign debt built up to a staggering level of USD 6.7 billion by the end of march 2017. This is already above 100% of GDP. Nevertheless, the foreign currency reserves evolved reasonably well under circumstances and even more so if the difficulties in developing its exports are taken into consideration.

The Moldovan banking sector, which was important in the context of Moldova's membership, was quite different as compared to other countries in transitions, including Romania. Moldova inherited from the former Soviet Union four branches of its former specialised banks, of which one for agriculture, one for industry, trade and services, one for financing the social sector and the last one for keeping deposits/savings of the population. The four entities were rapidly adjusting to the new realities and became universal banks after 1991. This is the short narrative of the four largest banks of the country in the early days of the transition: Moldova-Agroindbank, Moldindconbank, Banca Socială and Banca de Economii (Banca de Economii, Banca Sociala have entered into a liquidation process in 2016). In parallel, new private banks were established and started to develop. All commercial banks in Moldova started to apply international accounting standards, in a process which is yet to be finalised.

Recent Evolutions, Serious Challenges

The status of the Moldovan Leu, both internally and externally, was under heavy pressure during the last 5 years. The supervision of the NBM up to the end-March 2016 was not up to standards. The Moldovan banking sector was plagued by severe scandals, of which the so called "Moldovan laundromat" of Russian money and the huge banking fraud (around USD 1 billion) were the most damaging for Moldova and the Moldovan Leu. Regarding the first scandal, in summary some Moldovan banks were involved in money laundering transactions involving Russian funds, Russian entities, commercial banks from Moldova, the Russian Fe-deration and the Baltics and Moldovan state legal entities/authorities (courts, prosecutors, bailiffs, public notaries, lawyers, etc.). According to independent analysts, some USD 20 billion (more recent figures put this at USD 22 billion) were "laundered" from the Russian Federation to off-shore jurisdictions in rather sophisticated schemes.

One collateral negative impact of the money laundering and of the banking fraud toxic transactions was the unprecedented increase of the non-performing loans in the Moldovan banking sector. The sharp increase from 9.79% as of end-September 2015 to 16.31% as of end-2016 was caused in principal by two key trends - one more negative than the other. The first trend was the absolute increase of the non-performing loans from 3,877.24 million lei to 5,669.86 million lei during this period which is having to do with the state of the economy and the economic attitude of a society traumatised by the banking fraud. The second more worrisome trend was the decline of total loans from 39,613.06 million lei to 34,761.27 million lei. The second trend had a substantial impact on the economic growth of the country and hence on the recent weakness of the Moldovan Leu in a turbulent geo-political regional context.

In addition, one other serious problem of the Moldovan banks was related to the very existence of non-transparent shareholders in almost all the banks in the country (apart from few medium and small banks with reputable foreign shareholders such as Mobiasbanca (part of Groupe Societe Generale) and BCR Chisinau (part of Erste Group)). This led to or allowed "raiders attacks" on the shares of largest commercial banks, such as Moldova-Agroindbank and Victoriabank and of some insurance companies. In this respect, the supervision of the NBM failed again until a new governor was appointed by the Moldovan Parliament (Decision no. 31 dated 11 March 2016 with the starting date of 11 April 2016) when measures to correct this unacceptable situation started to be implemented.

Under such circumstance, corroborated with a large scandal as presented above, the currency sharply depreciated to 20.87 lei/EUR and to 20.04 lei/USD, respectively, as of end-2016. During 2015-2016 the level of 22.00 lei/EUR was overpassed which is to show the weakness and the fragility of a young currency unable to weather the extreme conditions derived from scandals, frauds and a struggling economy of a country at cross-roads. A fragile strengthening trend was, however, registered in 2017.

Arch Over Time

Over the last 20 years, Moldova's economic, banking and financial landscape changed a lot in various ways. From the data presented below in Table 2, an economic and monetary parallel could be drawn between the days when Moldova gained full membership with both the IMF and the World Bank and its current status.

Concluding Remarks

From the data presented above, a few conclusions could be safely drawn:

• Moldova started the transition process in August 1991 with a huge potential positive financial advantage, namely no foreign debts. However, this was lost in a very short period of time, with heavy consequences on the destiny of the Moldovan Leu;

• The transition process, from a historical prospective, could be labelled as early stages of transition, but it should be noted that Moldova suffered during the last quarter of a century from a wild accumulation of wealth and political power by the newly born oligarchs. The local oligarchs have left very negative marks on the evolution of Moldova and its external image;

• The Moldovan currency benefited during the last two decades from significant remittances from abroad. The large transfers helped considerably the Moldovan Leu to stay afloat, but the trends are on the declining side during some quarters or even years.

Pressure on the currency will continue, especially if the remittances will decline;

• The economic potential of Moldova is good. The country is well positioned to harness this potential. It also signed a Deep and Comprehensive Free Trade Agreement (DCFTA) with the EU in June 2014 (with full effect from 1 July 2016), but the benefits are still to be fully utilised;

• Building a strong economy should be a national goal for Moldova. Adherence to it by the whole community, local authorities, commercial banks, central bank, government and politicians is crucial. Without all moving together in the same direction and in a well-coordinated manner, Moldova will not flourish. Its current good potential is there and waiting to be harnessed;

• In this endeavour, Moldova could be helped by both the IMF and the World Bank. Twenty-five years on, the country's membership to these two major IFIs still matters.

• Therefore, the celebration of the 25-th anniversary of Moldova's membership this year is entirely justified and full of positive significance. Many happy returns!■

_____________________________________________________________________

The assessments and views expressed are not those of the IMF and/or the World Bank and/or NBM and/or the EBRD and/or indeed of any other institution quoted. The assessment and data are based on information as of end-May 2017.

Alex Tanase is an Independent Consultant and Former Associate Director, Senior Banker at EBRD and former IMF Advisor. He was in charge for preparation of Moldova's membership at the IMF up to the signing on 12 August 1992.

Vasile Patrascu is a former Advisor of the Minister of Economy and Finance of Moldova. He was in charge at the working level with the prepara-tion of the documentation for Moldova's membership at the IMF.

Add Comment